As an accountant, you’re likely familiar with the AICPA’s life insurance program. But how does it compare to individual life insurance policies?

This comprehensive review updated for 2024 will examine the details of the AICPA program, weigh its pros and cons, and compare it to other types of individual life insurance coverage so you can make an informed decision about your life insurance.

- What Is AICPA Life Insurance?

- CPA Level Premium Term Life

- CPA Level Premium Term Life Rates

- CPA Level Premium Term Life Underwriting

- How Does CPA Level Premium Term Life Compare?

- CPA Life

- CPA Life Rates

- CPA Life Underwriting

- Annual Cash Refund

- Did Your Annual Cash Refund Decrease This Year?

- Should You Get AICPA Life Insurance?

- FAQ

What Is AICPA Life Insurance?

As an accountant, you know about the AICPA life insurance programs.

The American Institute of Certified Public Accountants (AICPA) was founded in 1887 and has close to 500,000 members.

The AICPA Member Programs offer group life products issued by Prudential in partnership with AON.

Like most group life insurance policies, you (or a spouse) must be a member to get AICPA life insurance.

A third product, Group Variable Universal Life, has been discontinued. The AICPA does not offer guaranteed-issue final expense life insurance.

And while the AICPA website says this:

“AICPA Member Insurance Programs is a trusted advocate for CPAs, providing exclusive access to superior risk solutions that safeguard their livelihoods and protect their lifestyles.”

AICPA Member Insurance Programs

We aim to tell you about AICPA’s accountant life insurance products and how they compare to individual life products.

We think you should trust but verify their ” superior ” claim regarding life insurance.

CPA Level Premium Term Life

The CPA Level Premium Term Life product offers a 10-year or 20-year level premium group life product.

CPA Level Premium Term Life and Spouse Level Premium Term Life Highlights:

- Ages 18-65 for ten years, 18-55 for a 20-year term

- Coverage amounts to $2,500,000 (the maximum available depends on age)

- Under age 55 = $2.5 million

- Age 55-64 = $2 million

- Age 65-69 = $1.5 million

- Age 70 or older = $750,000

- Level term lengths of 10 or 20 years

- Three rate classes

- Preferred rates – exam is required

- Select rates

- Standard rates

- Optional AD&D Coverage

- Accelerated Benefit Option

- Optional Dependent Child Coverage

- Coverage requires continued membership

CPA Level Premium Term Life Rates

Here’s the AICPA Level Premium Term Life Insurance Rate Table as of 6-13-2024. Rates have not changed since 2021.

How do AICPA Level Premium Term rates compare to the individual term life insurance companies? As you can see, it’s not even close even if you factor in the Annual Cash Refund.

| Company | 10-Year Term | 20-Year Term |

|---|---|---|

| AICPA | $27, $24 with refund | $43, $38 with refund |

| Corebridge | $18 | $29 |

| Symetra | $18 | $29 |

| Pacific Life | $18 | $29 |

| Protective | $19 | $29 |

Rates for females as follows:

| Company | 10-Year Term | 20-Year Term |

|---|---|---|

| AICPA | $20, $18 with refund | $32, $29 with refund |

| Corebridge | $16 | $25 |

| Banner | $18 | $24 |

| Pacific Life | $16 | $24 |

| Protective | $17 | $24 |

Group life insurance policies don’t compete with individual policies on price, benefits, conversion periods, or policy control.

CPA Level Premium Term Life Underwriting

Standard, Select, and Preferred underwriting rate classes are available for the CPA Level Premium Term Life product.

You’ll be asked an initial set of five eligibility questions no matter what rate class you apply for:

- Has your mother or father died before age 60 due to heart disease, stroke, or cancer (does not include stepparent(s) or adoptive parents)?

- In the last three years, has your driver’s license been revoked or suspended, or have you been convicted of driving under the influence of alcohol or drugs?

- Within the last 12 months, have you used tobacco or nicotine in any form?

- Have you, in the last three years, flown in an aircraft, glider, or balloon in which you operated or had duties aboard, or do you anticipate flying in an aircraft, glider, or balloon in which you will have duties aboard? Or, are you participating in ultra-light flying, ballooning, parachuting, mountaineering, rodeo riding, motorized racing, hang gliding, parasailing, or bungee jumping?

- In the past five years, have you received treatment, counseling, or participated in a rehabilitation program for drug or alcohol abuse?

A paramedical exam may be required, mainly if you apply for the preferred rates.

As a comparison, we have life insurers offering you $500k – $2 million with no medical exam.

How Does CPA Level Premium Term Life Compare?

It doesn’t even come close to what is available in the individual term life insurance market. Progressive Life Insurance Company is another uncompetitive company with its term product.

For example:

| Description | CPA Level Term | Individual Term Life |

|---|---|---|

| Term Lengths | 10 or 20 years | 1-40 years |

| Coverage Available | $2.5 million | $100+ million |

| Accidental Death Rider | Yes, optional | Yes, optional |

| Child Rider | Yes, optional | Yes, optional |

| Accelerated Death Rider | Yes, included | Yes, included |

CPA Life

The CPA Life plan and the identical Spouse Life plan are the most popular group life policies purchased by members, with approximately 124,000 members insured with these plans.

CPA Life Highlights:

- Available for ages 18-74

- Coverage can last up to age 80

- Coverage amounts to $2.5 million, depending on your age.

- Rates increase in 5-year age bands starting at age 30

- Three underwriting rate classes:

- Standard rates for ages 18 up to age 45

- Select rates for ages 45-74

- Preferred rates for ages 50-74

- Select and Preferred rates require evidence of good health every 20 years.

- Accelerated Death Benefit Option for Terminal Illnesses – Included

- Accidental Death and Dismemberment (AD&D) Coverage – Optional

- Disability Waiver – Optional

- Dependent Child Coverage – Optional

When considering spouse life insurance, you always want to compare the benefits and features of an individual policy vs. a spouse rider.

CPA Life Rates

You will also find the CPA Life Insurance Rate Table – Monthly Gross Costs and Annual Refund Information here:

Rates increase in 5-year age bands starting at age 30.

To help manage your cost, you may apply for reduced Select rates at age 45 and lower Preferred rates at age 50.

CPA Life Underwriting

The CPA Life product offers “CPA Life Express” underwriting. If you meet the criteria, you can obtain coverage in minutes.

CPA Life Express Underwriting Criteria

- Ages 18-39

- Up to $1,000,000

- No medical exam is required

- Must be actively at work at least 17.5 hours per week.

After answering some basic questions, underwriting will check the Medical Information Bureau and issue its decision to you.

If you don’t meet the express underwriting criteria, here’s how it works for everyone else.

CPA Life Underwriting

Insureds aged 18-74 may apply for up to $2,500,000 coverage.

The maximum coverage amount available is based on your age:

- $2,500,000 – Ages 18-54

- $2,000,000 – Ages 55-64

- $1,500,000 – Ages 65-69

- $750,000 – Ages 70-74

At age 75, a member’s Life Insurance reduces to 50% of the previous amount or $500,000, whichever is less.

The CPA Life plan offers three underwriting rate classes:

- Standard – available to insureds under age 45.

- Select – available to insureds aged 45-74.

- Preferred – available to insureds aged 50-74.

The “Preferred” rate always requires a paramedical exam. In contrast, the “Standard” and “Select” rate classes are eligible for accelerated underwriting and no exam.

If you are a foreign national needing life insurance, the AICPA program is not for you.

Annual Cash Refund

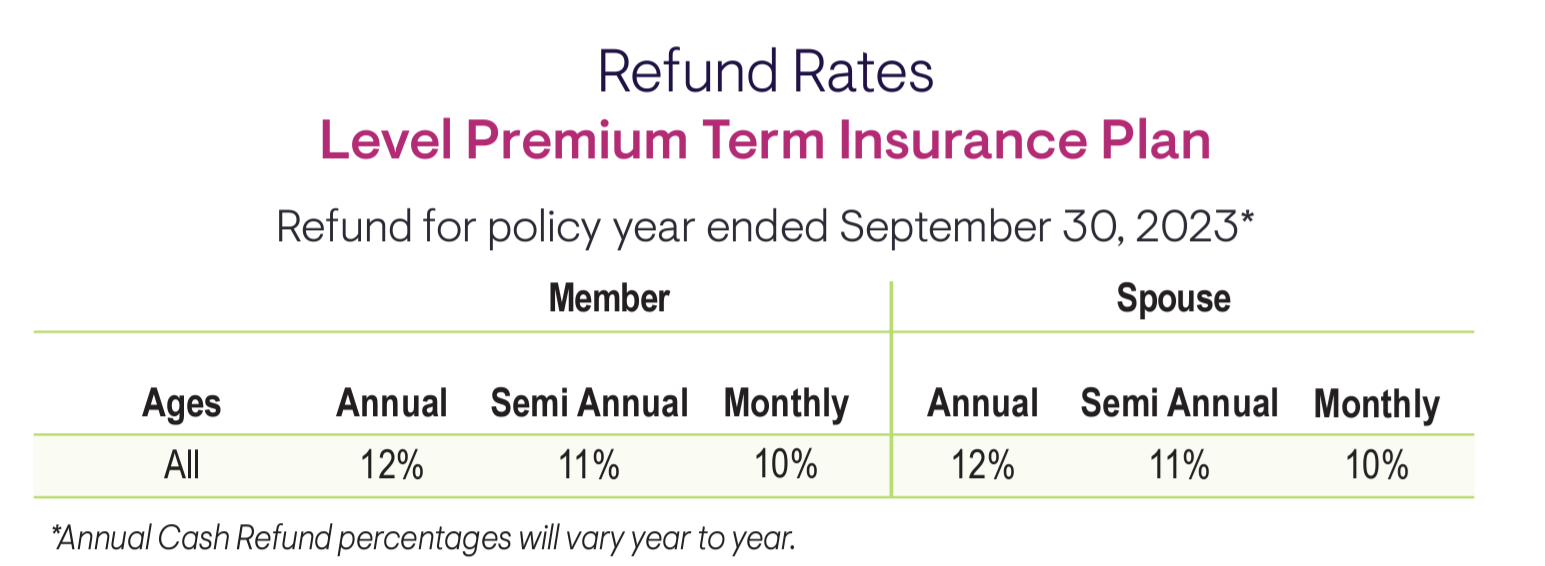

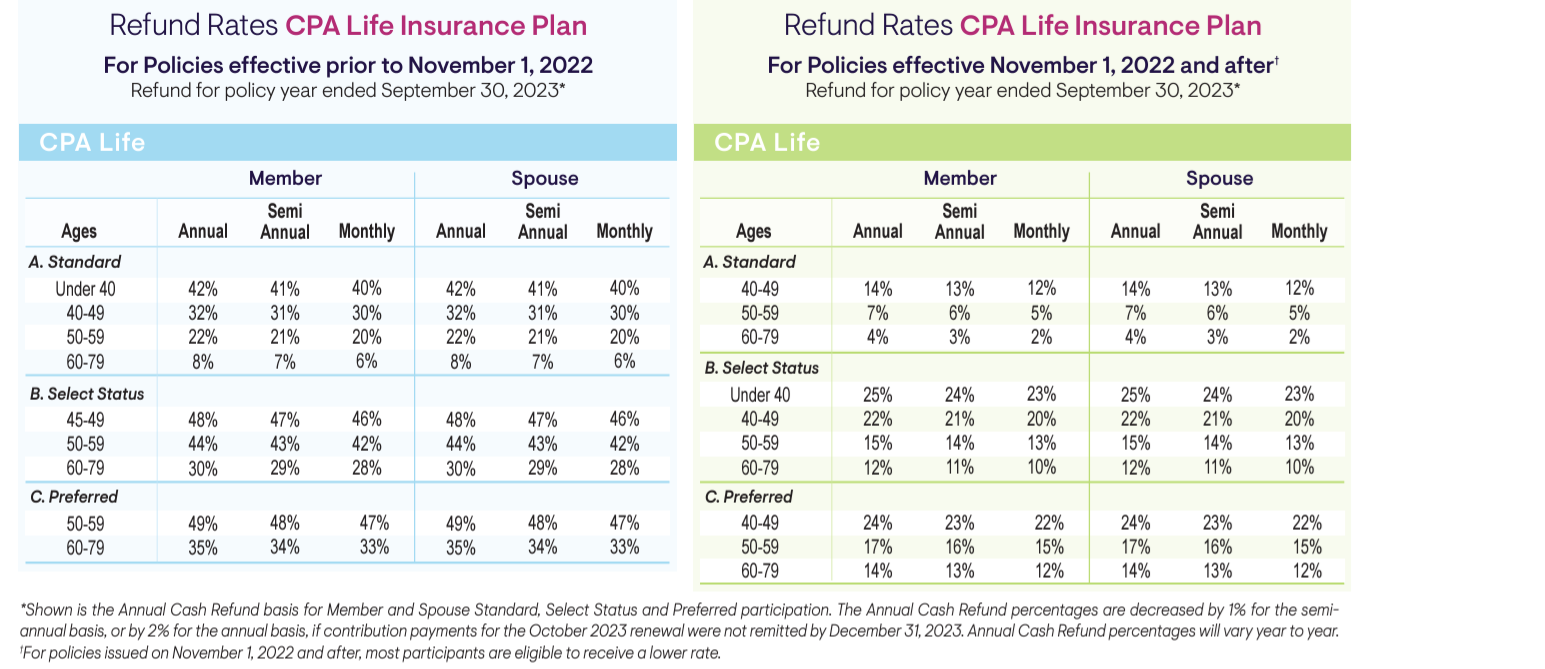

The Annual Cash Refund is a unique feature of the CPA Life and CPA Level Premium Term Life products.

The money not used by the group life insurance plan for expenses, claims, and Prudential refunds other charges to the participants through the AICPA Insurance Trust.

The amount you may receive is based on your age, payment basis, rate class, and type of product purchased.

It’s similar to a universal life insurance policy where you withdraw cash value annually.

While the Annual Cash Refund is not guaranteed and may vary yearly, a refund has been issued every year of the Plan.

Did Your Annual Cash Refund Decrease This Year?

As you can see in the chart above, there have been substantial decreases in the refund rate for the CPA Life product.

The term life product refund increased since we last did this review in 2022.

If you’re wondering why the annual cash refund decreased, the AICPA Life Insurance/Disability Plans Committee report has the answer.

Like the rest of the life insurance industry, COVID-19 has impacted claims with insurance carriers. However, the report indicates that the committee worked persistently “to adapt to a new normal.”

Annual Cash Refund – The number of claims processed for both

2022 AICPA Life Insurance/Disability Plans Committee report

Trusts across all products were significantly higher during the

last Plan year than the prior Plan year.

Only time will tell if the annual refund is a good enough deal for you.

The AICPA also offers disability insurance that may be worth a look.

Should You Get AICPA Life Insurance?

First, the most important thing to do if you need life insurance is to get a life insurance policy.

It’s simple enough, but many people overlook getting enough coverage.

While the CPA Level Premium Term Life policies seem expensive compared to products available in the individual market, the CPA Life policy can be inexpensive, especially at younger ages.

The best advice we can give you is to compare the AICPA life insurance products to what we offer.

FAQ

You have questions about the AICPA life insurance program and we have the answers.

Final Words

AICPA life insurance offers benefits for accountants, but it’s important to compare it to individual policies to ensure you’re getting the best coverage and value for your needs.

Our service gives you the information you need to decide whether the AICPA or individual life insurance plan is your best option.

There is never any pressure or obligation with our service.

With that in mind, we hope this article has helped guide you toward the right decision for you and your loved ones.