Is Colonial Penn’s $9.95 Plan Worth Your Time and Money? As a licensed insurance agent and customer, I bought Colonial Penn’s $9.95 plan to provide you with an insider’s perspective.

Whether you’ve seen their ads featuring Jonathan Lawson or are researching affordable senior life insurance, this review will help you decide if it’s the right choice for you.

What You’ll Learn in This Review

- What the $9.95 plan offers (and what it doesn’t).

- How Colonial Penn compares to competitors like Mutual of Omaha and Transamerica.

- Alternative options for better coverage at lower prices

- Answers to common questions about Colonial Penn.

This is the first Colonial Penn company review completed by a licensed insurance agent and customer.

The Colonial Penn Experience

Colonial Penn’s $9.95 plan is marketed as affordable, simple, and accessible for seniors. The commercials promise:

It’s a simple message that resonates with consumers—so much so that Colonial Penn’s parent CNO reported almost $937 million in traditional life revenue in 2023!

But What Exactly Are You Getting?

The type of life insurance offered by the $9.95 plan is a whole life insurance policy that:

- Requires no medical underwriting – Great for high-risk health conditions.

- Offers limited benefits for non-accidental deaths during the first two years.

- Provides full death benefits after the two-year waiting period.

- Premiums remain fixed and are payable to age 100.

However, here’s the catch: Coverage is sold in units, and the amount of life insurance per unit depends on your age and gender. Older applicants and males receive significantly less coverage per unit than younger applicants and females.

Other features of the Colonial Penn whole life product include:

- Policy Loans – You may borrow against your policy’s cash value, but remember that this will reduce your death benefit.

- Non-Forfeiture Benefits – This feature provides extended-term insurance or a smaller paid-up death benefit if you stop paying premiums.

Your policy pages include charts indicating the extended-term life amount, paid-up insurance, and cash surrender value available if you cancel.

Two products not offered by Colonial Penn that retired individuals have expressed great interest in are universal life and long-term care insurance.

Important Note About Two Year Waiting Periods

Many believe a two-year waiting period is their only option, but there are life insurance options available with Day 1 coverage, even with health conditions like:

- Heart Conditions

- Cancer History

- GI Conditions

- High Blood Pressure

Companies that offer day 1 coverage include:

Another factor to consider is the amount of life insurance you need, as Colonial Penn is limited compared to the above companies.

My Application Experience

Applying for the Colonial Penn $9.95 plan is simple:

- Provide personal details.

- Select your coverage amount.

- Name your beneficiary.

- Answer basic questions about policy replacement and payment.

The process takes about 10 minutes, either online or over the phone. I received a confirmation email immediately, and my policy arrived a week later.

I received a confirmation email from Colonial Penn within minutes.

From my own experience as an agent working with seniors, a big concern is not to be a burden on their loved ones if they die.

Colonial Penn nails this better than 99% of the insurance companies out there! If nothing else, this company brings great awareness to the life insurance industry.

While Colonial Penn excels at convenience, this convenience comes with drawbacks—limited benefits and a higher cost than competitors.

How Does Colonial Penn Stack Up?

Is Colonial Penn worth the money?

Colonial Penn sells life insurance by unit from 1 to 15, while most companies sell life insurance by face amount (ex., $10,000, $15,000, $25,000).

Just remember that units do not equal life insurance.

For example, 15 units will not equal $15,000 of life insurance.

To facilitate comparison, we created the following charts, which convert units into face amounts of life insurance.

Colonial Penn $9.95 Chart by Age

The amount of life insurance you get per $9.95 unit depends on your age & gender. The older you are, the less life insurance you receive per unit. Women receive more life insurance per unit than men.

| Age | Female Life Insurance Per Unit | Male Life Insurance Per Unit |

|---|---|---|

| 50 | $2,000 | $1,669 |

| 51 | $1,942 | $1,620 |

| 52 | $1,890 | $1,565 |

| 53 | $1,845 | $1,515 |

| 54 | $1,802 | $1,460 |

| 55 | $1,761 | $1,420 |

| 56 | $1,719 | $1,370 |

| 57 | $1,669 | $1,313 |

| 58 | $1,620 | $1,258 |

| 59 | $1,565 | $1,200 |

| 60 | $1,515 | $1,167 |

| 61 | $1,460 | $1,112 |

| 62 | $1,420 | $1,057 |

| 63 | $1,370 | $1,000 |

| 64 | $1,313 | $949 |

| 65 | $1,258 | $896 |

| 66 | $1,200 | $846 |

| 67 | $1,167 | $802 |

| 68 | $1,112 | $762 |

| 69 | $1,057 | $724 |

| 70 | $1,000 | $689 |

| 71 | $949 | $657 |

| 72 | $896 | $627 |

| 73 | $846 | $608 |

| 74 | $802 | $578 |

| 75 | $762 | $549 |

| 76 | $724 | $521 |

| 77 | $689 | $493 |

| 78 | $657 | $468 |

| 79 | $627 | $441 |

| 80 | $608 | $426 |

| 81 | $578 | $424 |

| 82 | $549 | $423 |

| 83 | $521 | $421 |

| 84 | $493 | $420 |

| 85 | $468 | $418 |

Check out these examples:

- Female

- Age 65

- 1 Unit = $1,258 of life insurance = $9.95 Per Month

- 10 Units = $12,580 of life insurance = $99.50 Per Month

- 15 Units = $18,870 of life insurance = $149.25 Per Month

- Male

- Age 65

- 1 Unit = $896 of life insurance = $9.95 Per Month

- 10 Units = $8,960 of life insurance = $99.50 Per Month

- 15 Units = $13,440 of life insurance = $149.25 Per Month

As you can see, there is a significant difference in the amount of coverage you receive by gender.

How Do Colonial Penn Rates Compare to Competitors?

Do not buy Colonial Penn’s graded life insurance policy if you’re healthy. You will qualify for an underwritten policy that provides a greater death benefit at a lower premium.

We’ll use the age 65 example again for 15 units of coverage with Colonial Penn:

- Females – 15 units x $1258 = $18,870 of life insurance for $149.25 per month

- Males – 15 units x $896 = $13,440 of life insurance for $149.25 monthly.

Pacific Life offers a $25,000 guaranteed universal life insurance policy for $79 per month for females or $87 per month for males.

Protective Life, owned by Japanese life insurance company Dai-Chi Life Holdings, offers $50,000 of coverage guaranteed to age 121 for $126 per month for females or $140 per month for males.

Remember that you need to qualify medically for the Pacific Life and Protective policies.

If you have health issues, we can discuss them to determine whether Colonial Penn or some other graded benefit policy is best for you.

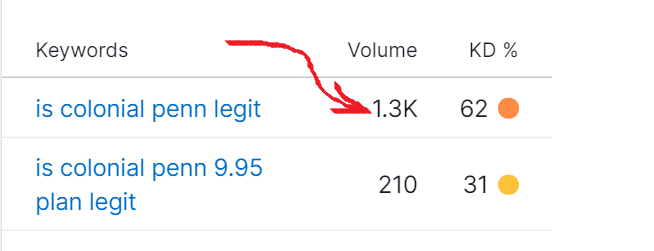

Is Colonial Penn Legit?

You’re not alone if you are asking this question about Colonial Penn.

According to our keyword research tools, this question gets asked 1,300 times per month!

Colonial Penn is owned by CNO Financial Group, which has $35.1 billion in assets and $937 million in life insurance premiums in 2023.

AARP founder Leonard Davis founded the company.

The company has a mix of positive and negative reviews, with common complaints about the limited benefits during the first two years and the $9.95 life insurance amount.

Financial Strength Ratings

According to CNO’s website, financial strength ratings as of 10/16/2024 are:

- AM Best – “A”

- S&P – “A-“

- Fitch – “A”

- Moody’s – “A3”

Ratings are subject to change. Other companies with similar or better ratings include Progressive Life Insurance Company.

Colonial Penn Negative Reviews

Colonial Penn has its share of negative reviews with the Better Business Bureau.

However, some people have had positive experiences with Colonial Penn.

If nothing else, the sheer volume of its advertising has raised awareness about the need for life insurance.

When you read through some reviews, the common theme seems to be the limited benefits during the first two years and the amount of life insurance that $9.95 buys you.

Colonial Penn is the only company we know of that charges by the unit rather than charging based on the amount of life insurance. It leads to lots of confusion.

Is Colonial Penn Deceptive or Misleading?

If you complete a Google search asking if Colonial Penn uses deceptive or misleading advertisements, you’ll see plenty of articles about that topic.

Here’s the thing – All insurance companies, including Colonial Penn, are subject to insurance department regulations in every state.

Bottom Line: Colonial Penn’s “unit” system of selling life insurance makes it difficult for consumers to compare it to other companies.

Your Acceptance is Guaranteed

If you listen to commercials or read the website, you’ll see and hear “your acceptance is guaranteed” throughout.

In our experience, many people think that a guaranteed acceptance policy is the only option until they learn from us that high-risk health issues like diabetes, cancer history, or heart disease are readily insurable with traditional life insurance.

You may qualify for a policy that provides immediate death benefits.

The advantage of fully underwritten life insurance is that you can get more coverage for less money than a graded benefit final expense policy.

Even if you’ve already purchased a policy elsewhere, let us show you how our companies compare. Our service is free of pressure or obligation.

Final Thoughts

Colonial Penn offers a convenient way to purchase small life insurance policies that do not require medical underwriting.

The pros are that coverage is easy and convenient, and the cons are that the unit pricing may be confusing compared to other companies.

Take a few minutes to request your quote today. With our service, there is never any pressure or obligation.