TruStage life insurance is marketed as affordable, no-hassle coverage offered through your credit union. But here’s the thing — just because your credit union recommends it doesn’t mean it’s the best deal.

Most TruStage policies skip the medical exam and use simplified underwriting, which sounds convenient. But in return, you’ll likely pay more for less coverage, especially if you’re in decent health.

In this review, we’ll show you how TruStage compares to major life insurance companies, where it falls short, and why you can probably do better.

TruStage Overview

TruStage offers coverage through credit unions. CMFG Life Insurance Company underwrites the policies.

These life insurance policies don’t require a medical exam. Instead, underwriting is handled using an automated system that checks prescription history and electronic health records for high-risk medical conditions. While this speeds up approval, it limits the competitive rates.

With over 80 years of history, it is promoted as simple and affordable protection exclusively for credit union members.

TruStage Life Insurance Products

Several types of life insurance products are available, including:

- TruStage Term Life Insurance

- Coverage lasts to age 80

- Premiums increase every 5 years (age bands: 25, 30, 35, etc.)

- No level term option

- Maximum face amount: $300,000

- Conversion to whole life insurance is available

- No medical exam, but basic health questions apply

Unlike traditional term policies from major insurers, TruStage term life isn’t level. Your rate increases as you move into each new 5-year age band, making it more expensive in the long run, especially for those seeking long-term protection.

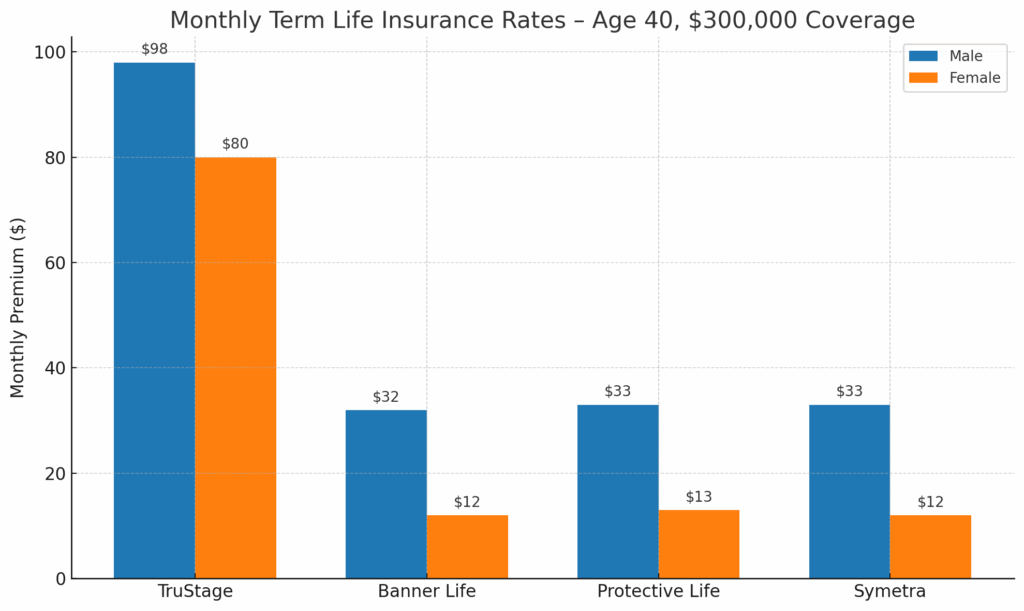

TruStage Term Life Insurance Rates

How do TruStage life insurance rates stack up? Not well, especially when compared to the industry’s most competitive options.

Your initial monthly rate is based on your current age and gender and will increase as you enter each five-year age band (25, 30, 35, 40, 45, 50, 55, 60, 65, 70, and 75).

Consider this example for a 40-year-old seeking $300,000 in life insurance. We compared TruStage rates to those of a 30-year term life insurance policy offered by other companies. Monthly rates.

| Company | Male | Female |

|---|---|---|

| TruStage | $98 | $80 |

| Banner Life | $32 – instant decision available | $12 – instant decision available |

| Protective Life | $33 | $13 |

| Symetra | $33 – instant decision available | $12 – instant decision available |

Your credit union is not doing you any favors by selling you TruStage term life insurance.

TruStage Simplified Whole Life Insurance

A simplified whole life insurance policy is available for those who qualify.

- TruStage Simplified Issue Whole Life

- Coverage amounts up to $100,000

- Lifetime coverage with fixed premiums

- Builds some cash value over time

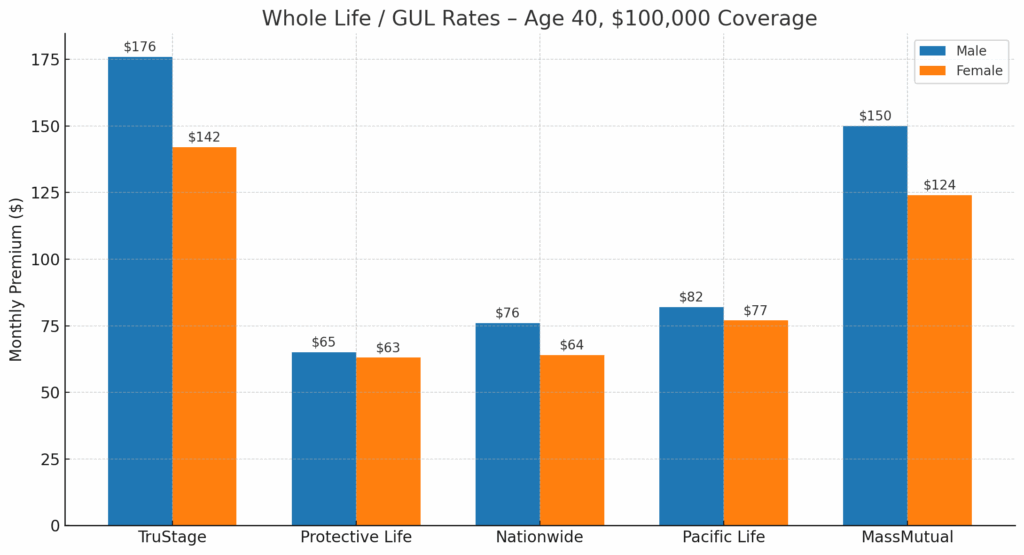

TruStage Simplified Whole Life Insurance Rates

How does TruStage compare to other companies that offer lifetime guarantees? Not very good.

Take a look at these universal life policies guaranteed to age 121.

We’ll use the same 40-year old for this example:

| Company | Male | Female |

|---|---|---|

| TruStage | $176 | $142 |

| Protective Life | $65 | $63 |

| Nationwide | $76 | $64 |

| Pacific Life | $82 | $77 |

| Mass Mutual – Whole life | $150 | $124 |

Many life insurance options provide more coverage at a lower price than TruStage whole life insurance.

TruStage Guaranteed Acceptance Whole Life

This policy is pitched as a way to cover final expenses.

- Guaranteed Acceptance Whole Life

- No health questions asked

- Coverage available from ages 45–80

- Maximum face amount: $25,000

- 2-year limited benefit period (natural deaths only receive a refund of premiums + 10%)

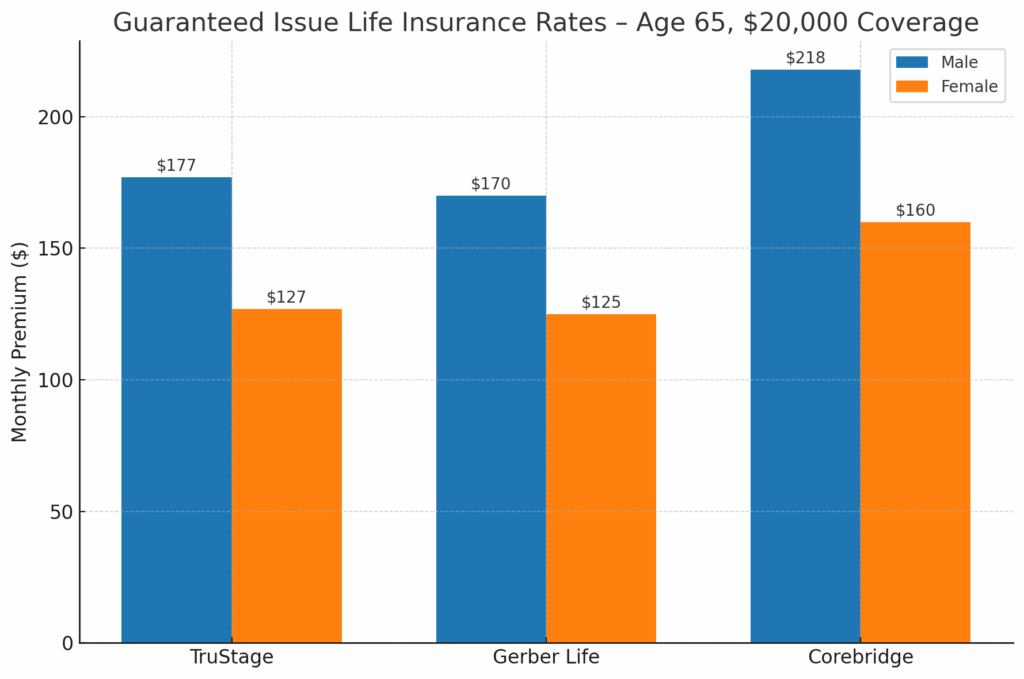

TruStage Guaranteed Acceptance Life Insurance Rates

How do TruStage’s guaranteed acceptance rates compare to those of other companies?

Rates are similar to those of other companies for the following scenario.

Want to understand why guaranteed issue coverage is usually a last resort?

Read our final expense insurance guide.

Compare life insurance rates for $20,000 coverage for a 65-year-old, which is the maximum coverage available with TruStage for this age group.

| Company | Male | Female |

|---|---|---|

| TruStage | $177 | $127 |

| Gerber Life | $170 | $125 |

| Corebridge | $218 | $160 |

Guaranteed issue policies should be considered a last resort. Most people who buy them still qualify for better-priced, simplified, or underwritten coverage.

What Makes TruStage Different?

TruStage relies on its partnership with credit unions to build trust with potential policyholders.

They highlight:

- No exam required

- Fast application process

- Endorsed by your credit union

- Customer service through phone or website

While this sounds convenient, the trade-off is a higher cost and more limited benefits. You pay for simplicity but get less value.

Where TruStage Falls Short

| Feature | TruStage | Other Companies |

|---|---|---|

| Underwriting | Simplified Only | Locked in for a term period from 1 – 40 years |

| Max Term Coverage | $300,000 | $65 + Million |

| Rate Structure | Increases Every 5 Years | Locked in for term period from 1 – 40 years |

| Conversion Options | Limited | Many – Universal and Whole Life |

| Premiums | Higher | Lower |

| Whole Life Maximum | $100,000 | $65 + Million |

Fully underwritten policies from top-rated life insurance companies offer:

- Term lengths up to 40 years

- Level pricing for the entire term duration

- Lower premiums

TruStage will not be your best option if you are in good health.

Who Might Consider TruStage?

There are situations where TruStage may be a good option, including:

- People who prefer no medical exams.

- Members who want to keep all their business with the credit union.

- Some may like the TruStage final expense insurance policy.

When You Should Look Elsewhere

There are many reasons to consider other life insurance companies, including:

- Health – You have great health

- Coverage Amounts – You need more than $300,000

- Fixed Pricing – You want to lock in your pricing for the entire term.

- Conversion Options – You want the ability to convert your term policy

Fully underwritten policies may take longer to complete underwriting, but can save you thousands!

TruStage is convenient and easy to apply for, but it’s usually not your best option. Their policies cost more than similar coverage from top-rated life insurance companies. If you’re in decent health, you can likely get better benefits at a lower price elsewhere.

No. TruStage uses simplified underwriting, which means you won’t need a medical exam. They check your health history electronically instead. While this speeds up approval, it also leads to higher premiums.

TruStage offers:

Term life insurance (rates increase every 5 years)

Simplified whole life insurance

Guaranteed acceptance whole life insurance (no health questions)

CMFG Life Insurance Company underwrites all policies.

No. TruStage’s term life insurance is not level. Your price increases every 5 years as you enter a new age band. This makes it more expensive over time compared to level term life policies from other companies.

TruStage term life insurance offers up to $300,000 in coverage. Whole life insurance policies can go up to $100,000, while guaranteed acceptance policies max out at $25,000.

Yes. Companies like Banner Life, Protective Life, Pacific Life, and Prudential often offer lower premiums, more coverage, and better conversion options. If you’re in good health, you may be eligible for better pricing.

Final Thoughts

TruStage life insurance is convenient, backed by a reputable brand, and easy to buy. But it’s far from the most competitive option.

If you’re relatively healthy, you can get more coverage and pay less with other providers like Banner Life, Protective, Prudential, or Pacific Life. These carriers offer level term policies, higher death benefits, and better long-term value.

Before you buy a TruStage policy, compare quotes. You might be surprised at how much more you can get for less.

Need Help Finding the Right Life Insurance?

You don’t have to settle for overpriced, limited coverage.

Get quotes from the best life insurance companies — with better pricing, better options, and expert help.

Request Your Life Insurance Quote Now