Worried About High Liver Enzymes? Don’t Be!

If your life insurance test showed elevated liver enzymes, don’t panic! Many people still get coverage. It’s all about knowing which life insurance companies to work with and which to avoid.

Can You Get Life Insurance With Elevated Liver Enzymes?

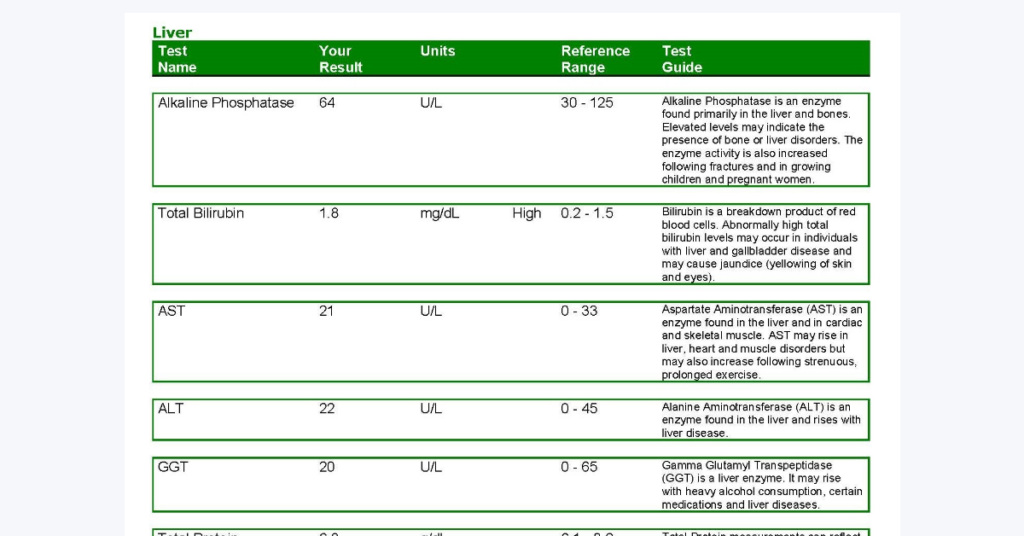

Yes, many people get approved for life insurance even if they have a high-risk condition like elevated liver enzymes. Life insurance companies review your liver health using tests like:

- ALT – (Alanine Aminotransferase)

- ALP – (Alkaline Phosphatase)

- AST – (Aspartate Aminotransferase)

- GGT – (Gamma Glutamyl Transferase)

- Total Bilirubin

The results help insurers decide what type of life insurance is available and at what rate. If your liver is healthy or if there’s a medical concern. Some conditions, like liver disease, hepatitis, or alcohol abuse, may affect your rates.

How Do Insurance Companies Decide Your Rate?

Life insurance underwriters (the people who decide your rates) look at:

Many people don’t know they have high liver enzymes until they complete a paramedical exam. It’s a common condition with several possible causes.

What Life Insurance Rate Can You Expect?

Your life insurance rate depends on how high your liver enzymes are:

- Less than 2x normal – Standard or Standard Plus rates (Good)

- 2-3x normal – Standard or Table 2 Rating (higher cost)

- 3-4x normal – Table 2 to Table 4 rating (More expensive)

- Greater than 4x normal – The company will review before making a decision.

If you have other health conditions, this may also affect your rate.

Questions Life Insurers Ask About Liver Enzymes

To decide your rate, insurers will ask:

- Have you had high liver enzymes before?

- What were the results for the following:

- Alkaline Phosphatase (ALP)

- Alanine Aminotransferase (ALT)

- Aspartate Aminotransferase (AST)

- Bilirubin

- Gamma Glutamyl Transferase (GGT)

- Were any other lab results outside of normal ranges?

- If yes, which tests and what were the results?

- Do you drink alcohol?

- If yes, what do you drink, and how often?

- Have you had any follow-up tests (ultrasound, biopsy, etc.)?

Certain medications, illnesses, or even exercise before a test can raise your liver enzymes.

What if You Were Denied Life Insurance?

If an insurance company denies coverage, don’t give up! Some insurers specialize in high-risk life insurance and may offer you coverage.

Here’s what you can do:

- Work with an expert (hint, hint) – Someone who specializes in high-risk life insurance.

- Try another life insurance company – Some companies are easier to work with.

- Get a second opinion – You may need additional testing first.

We work with life insurance companies that specialize in underwriting liver enzymes.

What if You Get a Table Rating?

If you get a table-rated offer (higher rates due to health risks), accept the policy for now. You never want to go through a biopsy or ultrasound first because those results could make you uninsurable.

If your test results are favorable, we’ll use them to negotiate a better price; if not, you’ll already have coverage locked in.

Health Conditions That Raise Liver Enzymes

Several health conditions can cause high liver enzymes, including:

- Hepatitis – Hepatitis is a liver inflammation that can cause scarring (cirrhosis).

- GI Conditions – Ulcerative colitis and Crohn’s disease may elevate liver functions.

- Fatty Liver Disease – Extra fat in the liver, common in obesity and diabetes.

- Alcohol Use – Drinking can cause elevated liver enzymes.

How to Improve Your Chances of Getting Life Insurance

If you have high liver enzymes, follow these tips before your life insurance exam:

- Don’t exercise for 24 hours before (it can temporarily raise enzyme levels)

- Avoid alcohol for a week before your test.

- Reschedule if you are sick – (being sick during your exam can elevate results)

Some medications and herbal remedies raise liver enzymes. Make sure you disclose them on the application, as they can be used to explain elevations.

Take the Next Step to Get the Best Coverage

Take a few minutes to request life insurance quotes from us. We’ll use the information to get underwriting feedback from the best life insurance companies available.

If you have other health issues like heart disease, AFib, skin cancer, or a history of prostate cancer, we’ll review that information as part of our process.

Final Thoughts

Having high liver enzymes doesn’t mean you can’t get life insurance. Every company looks at your health differently, and we specialize in finding the best rates for high-risk applicants.

If you’ve been denied or received a rated policy, contact us. We’ll help you find a policy that works for you!

Technical Underwriting Guidelines

The following are based on actual insurance company underwriting guidelines.

- Alkaline Phosphatase (ALP): Normal is 44-147 IU/L

- 3-5x normal = standard rates

- >5x = postpone/decline

- Alanine Aminotransferase (ALT): Normal is 45 U/L

- <4x normal = standard

- 4-5x normal = Table 2

- >5x = postpone/decline.

- Aspartate Aminotransferase (AST): Normal is 45 U/L

- <5x normal = standard

- >5x normal = postpone/decline.

- Bilirubin: Normal is 0.3 – 1.2 mg/dl

- <6 mg/dl = standard

- >6 mg/dl = postpone/decline.

- Gamma Glutamyl Transferase (GGT): Normal is 65 U/L

- <4x normal = standard

- 4-5x = Table 2

- >5x normal = postpone/decline.

What if Multiple Liver Enzymes Are Elevated?

Underwriting becomes more complicated for multiple elevated results. Underwriters look at how elevated the enzyme results were:

- Less than 2x normal = Standard rates

- 2-3x normal = Table 2 (50% extra)

- 3-4x normal = Table 4 (100% extra)

- 4-5x normal = Table 6 (150% extra)

- Greater than 5x normal = postpone/decline until evaluated.

Keep in mind these are general guidelines. Your outcome could be better or worse.