Life insurance for someone with a history of heart surgery can be difficult to find. We make it easy.

Here’s What We Do for Clients

Your age, heart surgery details, cardiac follow-up, and current health are major factors

Bypass History #1

Male, Age 70 – $400,000

- Quad bypass at 46

- Quad bypass at 62

- Favorable cardiac workups

- BP & Cholesterol Meds

Shopped our companies

- John Hancock – Table 4

- AIG – Table 5 – 6

- Prudential – Table 6

- Omaha – Table 5

- Brighthouse – Table 6

- Six Declines

The best offer was AIG at a Table 6 rating due to how their pricing works.

Bypass History #2

Male, Age 58 – $500,000

- Bypass surgery at 56

- Two vessels bypassed

- Favorable cardiac workups

- BP & Cholesterol Meds

Shopped our companies

- AIG – Table 6

- Prudential – Table 5

- Protective – Table 2

- John Hancock – Table 4

- Lincoln – Table 2

- Other companies – T6+

The best offer was Protective at a Table 2 rating.

Bypass History #3

Male, Age 51 – $1,000,000

- Heart attack at 49

- Triple bypass

- Favorable cardiac workup

- BP & Cholesterol Meds

Shopped our companies

- AIG – Table 5

- Prudential – Table 4

- Nationwide – Table 4

- John Hancock – Table 4

- Lincoln – Table 6

- Others – Table 6+

Best offer was AIG due to more favorable pricing on ratings.

We take the time to understand your heart bypass history and match you with the best life insurance companies.

It’s important to know the exact details of your bypass history, including:

With these details, we can shop the market for underwriting offers.

Benefit #1 – Open Heart Surgery History saves here

Affordable life insurance is available if you’ve had coronary artery bypass graft (CABG) heart surgery and need life insurance.

You’ll know exactly what to expect before you complete an application.

There is never any pressure or obligation with our service.

Companies that underwrite heart attacks include:

- AIG – Corebridge Financial

- Banner Life

- John Hancock

- Lincoln National

- Nationwide

- Minnesota Life

- Pacific Life

- Penn Mutual

- Protective

- Prudential

- SBLI

- Symetra

- United of Omaha

- Zurich

Benefit #2 Underwriting Expertise with heart surgery

We’ve been helping heart bypass patients since 1998.

We have the experience and knowledge to help you get affordable life insurance after heart surgery.

- Quadruple bypass heart surgery

- Triple bypass heart surgery

- Stent history

- Poor cardiac followup

- Young age open heart surgery

- Other heart problems

Best Life Insurance after Open Heart Surgery

Do you need to know all the details of open heart surgery underwriting? Keep reading

Heart Surgery Life Insurance Underwriting

We offer many high-risk life insurance companies that specialize in heart conditions.

Here’s what we need to know to provide accurate quotes:

- How old were you when you had open heart surgery?

- How many arteries and which ones were bypassed?

- Did you have angioplasty (stents) completed?

- If yes, how many and which arteries?

- Have you completed cardiac rehab and follow-up testing?

- What tests were performed? (stress test, echocardiogram, cardiac catheter)

- What was your left ventricular ejection fraction (LVEF) if known?

- Were the results from the follow-up stress test normal or abnormal?

- Were any other heart issues discovered? Angina, bundle branch blocks, arrhythmias, cardiomyopathy, mitral valve conditions, or atrial fibrillation.

- Do you have high blood pressure?

- Do you have any other health issues, such as asthma or diabetes?

- What medications do you take?

The above are the basic underwriting questions we ask about heart bypass surgery. There may be some additional questions based on your answers.

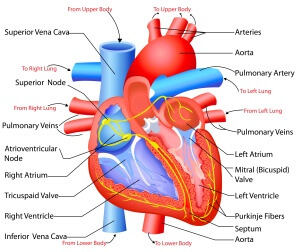

Heart vessels

- Left Main or left coronary artery (LCA)

- Left anterior descending (LAD)

- diagonal branches (D1, D2)

- septal branches

- Circumflex (Cx)

- Marginal branches (M1,M2)

- Right coronary artery

- Acute marginal branch (AM)

- AV node branch

- Posterior descending artery (PDA)

Those conditions affect underwriting if you’ve had other heart problems like atrial fibrillation, pacemaker, ventricular arrhythmias, stroke, mini-stroke, etc.

Life insurers look at the severity and damage to your heart, the number of arteries affected, treatment received, if you’ve had a heart attack, and your current health when determining the availability and pricing of life insurance.

Let us know about positive changes, such as exercise, weight loss, and quitting tobacco.

How RiskQuoter Helps Heart Bypass Patients

Once we have your health history, we use a quick quote to shop for underwriting offers.

A quick quote is a medical summary: we shop life insurance companies that specialize in heart problems. The benefit is that we’ll have underwriting feedback from all companies in 3-5 days.

At that point, we can provide you with life insurance quotes based on the type of life insurance you want, whether you want term life insurance, universal life, or whole life insurance.

What’s the catch?

There’s no catch. With our service, there is never any obligation or pressure. We give you the information you need to make an informed decision about your life insurance.

After we discuss your quotes, tell us to close your file if you’re no longer interested.

Open Heart Surgery Final Words

Life insurance is available after having open heart surgery, but it’s critical that you work with an expert who understands how high-risk life insurance works.

That’s where we can help you.

Please take a few minutes to submit your custom quote request today. Thank you.